An opportunity to establish

your eternal legacy.

Various amounts available

Explore DedicationsYour can help build the new

Valley Chabad Jewish Center.

Let's build it together

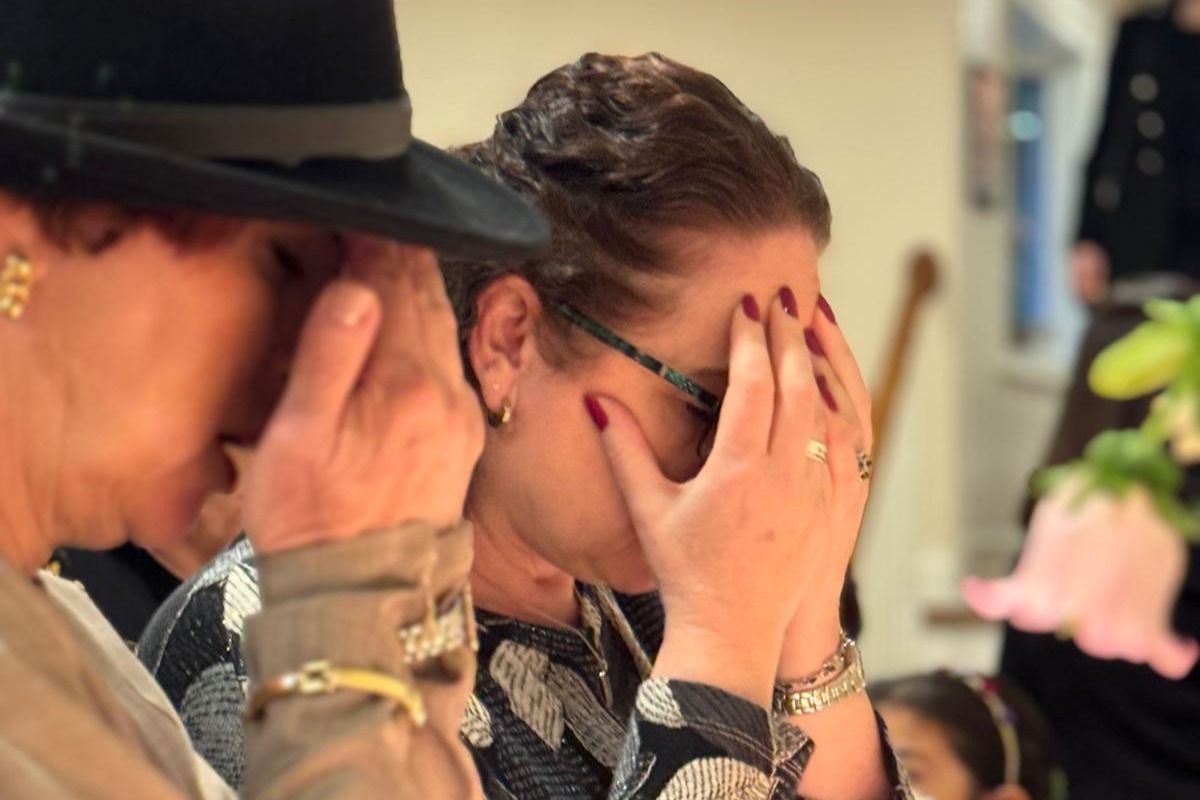

Learn MoreIn Memory of Barbara and Richard Baum

We're not just building a structure; we're creating a space for a vibrant community to come together and deepen the Jewish experience.

Our talented designers and architects crafted a unique space where Valley Chabad can nurture minds, warm hearts, and uplift souls.

Cultivate an inclusive Jewish community through classes, workshops, prayer, community Shabbat meals, counseling support, The Friendship Circle, and so much more.

We're grateful for the generous donations so far, but we haven't met our goals yet. This is where you can help.

Thank you for being in touch.

We'll get back to you soon.

Help spread the word: